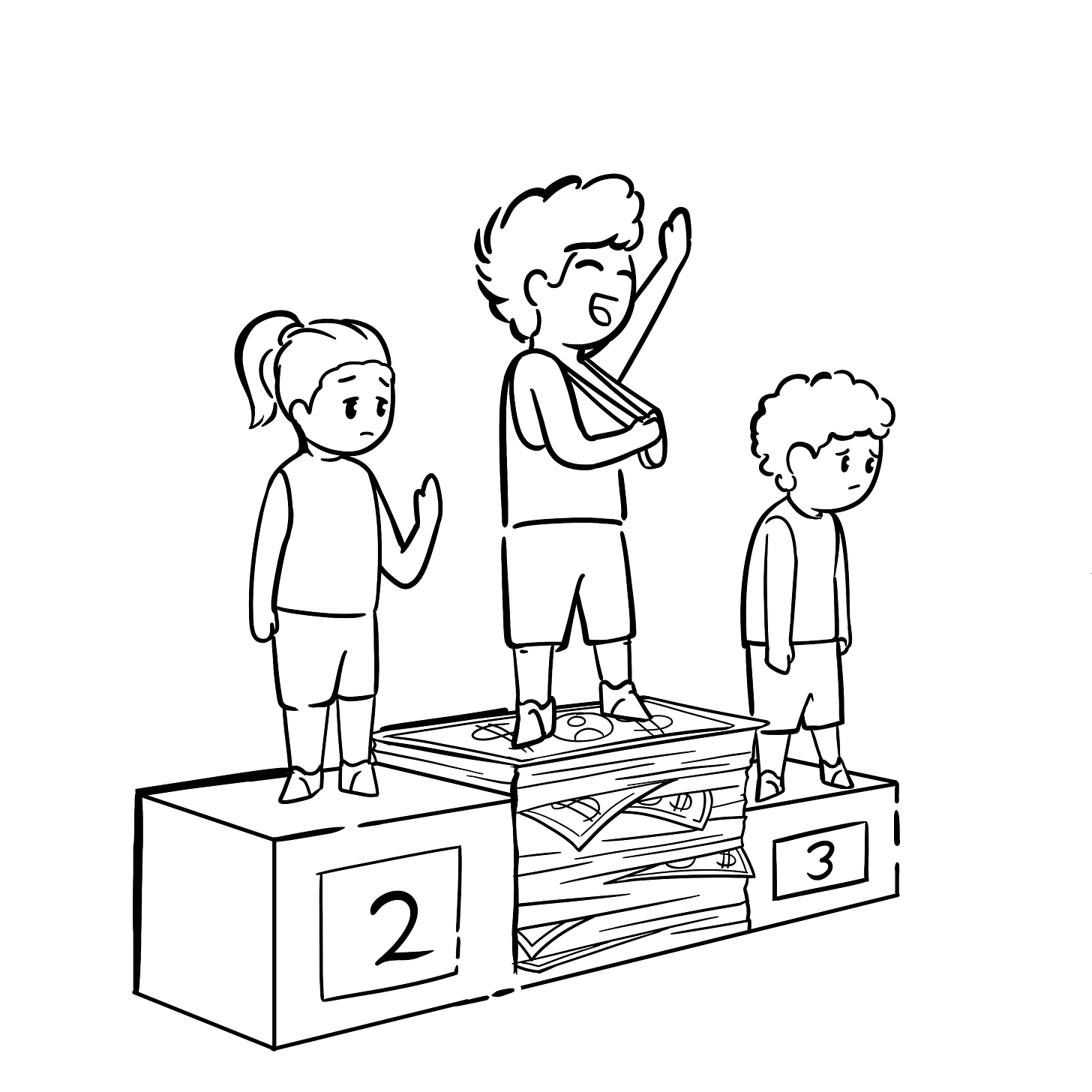

Create Financial Privilege for Your Children

Go beyond what others are doing to give your kids an insurmountable lead

Exordium

Privilege has become a dirty word, but let's be honest here, we are all working to establish that for our offspring. Parents go to extraordinary lengths for access to the best schools, extracurriculars and sports, tutors and test prep, exotic life experiences...the list goes on and on.

Ultimately, we are trying to provide the resources and tools to have the best life possible for our children and their children. That’s one of the most natural human desires I can think of…a leg up and every advantage possible.

However, on the Financial Front, many parents win the battle, but lose the war. While they are in trench warfare, fighting for yards, we want to Blitzkrieg right around the Maginot Line. With some non-conventional financial steps, often neglected, you can give your children a humongous financial head start.

Narratio

Most of the financial press would have you focus on cutesy jar systems for allowance. When your child is on the threshold of adulthood, with only theory under their belt, you are supposed to push them out of the nest like a baby bird and hope they can fly?

Most parents aren’t financially savvy themselves, because personal financial topics are taboo. In the financial world (along with sex), we think a little theory and the unrealistic information on the Internet should be enough. Hence, the large number of financial (and sexual) illiterates.

There are the obvious things, exempli gratia:

Give you child an allowance and teach them how to use it

Talk to them about money and model positive behavior

Have kids mow lawns, babysit, etc, to learn the value of work

Fund college savings accounts

All of these are good, and you are probably already doing them. But explaining the ordinary is like lecuring you to eat your vegetables. PLEASE SPARE US.

Partitio

There are more advanced opportunities. You know the amazing compounding effect of wealth over a lifetime; imagine you are now using their lifetime to extend wealth (and the closely correlated attribute → power).

Focus on financial leverage and asset building. Half the battle is often setting up the infrastructure and liquidity to allow them to capitalize on opportunities.

Confirmatio

Here are a few topics skirted by the mainstream financial press and advisors. Each of these is a topic for a future newsletter, so I will keep them brief and expand on each in the future:

Boost their critical credit score. Access to future capital at the best rates is a benefit the big players have. Add your children, in some cases as young as 12, as authorized users on your credit cards → that you pay on time and in full every month.

Set them up as employees of your (side) business and pay them W-2 wages. All that money can be saved and invested for them. And you get a valuable tax-saving business write off. The work can also be spun as work experience for future job or college applications.

Now that they have earned income, each year gift them Roth IRA money, matched up to their earned income, capped by annual IRA limits.

Create a legal entity (LLC), that they can be members of with you. Fully transition to them when they are 18 as a vehicle for future entrepreneurial endeavors or side hustles. Then leverage starting a business in their names in all sorts of other ways, including college admissions.

Create a financial infrastructure for them: youth savings & checking, and brokerage account (Fidelity has a good one). They will build off this infrastructure to set up automatic investments and other automation.

Regularly gift them money into this financial infrastructure/brokerage account, potentially up to annual limits.

Help/encourage them to develop cash-based businesses or side hustle (and I mean cash, not electronic payments or checks). You can leverage cash in special ways other transaction types cannot be…this requires future explanation.

Refutatio

What if my child is not mature enough?

Is this right for all kids? Absolutely not. You have to make judgement calls here. Consider this; is it better to wait until you have zero control (when you are dead) and pass your wealth in one big chunk? Or might it be better to start building you legacy on a manageable scale while you still have some influence with them? Plus, while they are still minors, you still have some actual legal control, especially with joint accounts, as we’ll explore later.

It is very Aristotelian, but you build trust by doing trustworthy things. Gift your child $10,000 in a joint brokerage account and work with them to manage it. This will do more than wishing one day they become “trustworthy”. This is how you build trust and confidence.

What about financial college aid? Won’t this sabotage them?

This newsletter is for a subset of society, the Atlas that hopefully won’t shrug…it is not for the proletariat. I expect people using this advice will not be eligible for true need-based financial aide, so it is not a concern.

Peroratio

If you want outcomes that are two or more sigma above the mean, then doing what everyone clustered at average will just produce average results.

This not a binary decision; either give my kids everything now and make them spoiled brats, or wait till I die so I can’t see them waste my legacy. Rather, this is a PROCESS of building financial leverage and capability. Giving them this kind of head start can separate them from the sheeple pursing the delayed life plan.

Experiment (which means some trial and error) and give them levers to create real wealth and leverage. They will learn to understand, direct and control wealth. They have their whole lifetimes to compound, so the small advantage you give them now will create a real legacy.

Veni, vidi, vici